Democrats’ $1.9 Trillion ‘American Rescue Plan’ to Fund COVID Relief & More (H.R. 1319)

Do you support or oppose this bill?

What is H.R. 1319?

(Updated March 12, 2022)

This bill was enacted on March 11, 2021

This bill — known as the American Rescue Plan Act of 2021 — would provide $1.9 trillion in funding for initiatives to provide economic relief and healthcare resources to mitigate the coronavirus (COVID-19) pandemic. It has been amended by the Senate to remove provisions that violate parliamentary rules for budget reconciliation bills, such as the increase in the federal minimum wage to increase to $15 per hour and funding for specific transportation infrastructure projects. A breakdown of the bill’s major provisions can be found below.

Stimulus Payments: This section would provide recovery rebates that total $1,400 for each adult and child in a household, including non-child dependents. Payments would be reduced for higher income taxpayers and begin phasing out at $75,000 in adjusted gross income (AGI) for individual taxpayers & $150,000 AGI for married filers. The rebate amount would be reduced by $5 for each $100 a taxpayer’s income exceeds the phase-out threshold; and it would phase out entirely for single taxpayers with incomes over $80,000 & married filers with AGI exceeding $160,000. The Internal Revenue Service (IRS) would base these AGI amounts on the taxpayer’s returns filed in 2019 and 2020. Payments would only be available to recipients who have a Social Security Number and are U.S. citizens.

Unemployment Insurance: The weekly federal enhancement of unemployment benefits under the Federal Pandemic Unemployment Compensation (FPUC) would be extended through September 6, 2021, and the weekly benefit would remain at $300. The first $10,200 of unemployment benefits would be tax-exempt for households with incomes under $150,000. Additionally, the Pandemic Unemployment Assistance (PUA) program would be extended until the same date, as would the temporary of short-time compensation payments to workers who had their hours reduced.

Tax Relief: This section would make the child tax credit (CTC) fully refundable for 2021 and increase the amount to $3,000 per child ($3,600 per child under age 6). It would also make 17 year old individuals eligible to be claimed under the CTC for 2021. Eligibility for the Earned Income Tax Credit (EITC) for taxpayers with no qualifying children would be increased for 2021, with the minimum age to claim it reduced from 25 to 19 (except for certain full-time students), in addition to changing its parameters to increase the maximum credit amount from $543 to $1,502.

Relief for Small & Shuttered Businesses: This section would provide $25 billion for a new program at the Small Business Administration (SBA) that would offer assistance to restaurants and other food and drinking establishments. Of the total, $5 billion would be set aside for businesses with less than $500,000 in 2019 annual revenue. Grants would be available for up to $10 million per entity, with a limit of $5 million per location, and entities would be limited to 20 locations. The first 20 days of the application window would be reserved for restaurants owned and operated or controlled by women, veterans, or socially and economically disadvantaged individuals.

An additional $7.25 billion for the Paycheck Protection Program (PPP) would be provided, raising its funding level from $806.4 billion to $813.7 billion.

Healthcare & Vaccinations: This section would provide $48.3 billion to the Dept. of Health and Human Services (HHS) for testing, contact tracing, and COVID-19 mitigation activities. It would also provide $7.5 billion to support the preparation, promotion, distribution, administration, and tracking of COVID-19 vaccines; $1 billion for activities to promote confidence in vaccines; plus $5.2 billion to support the vaccine supply chain.

It would also provide $7.6 billion for community health centers, $7.66 billion for expanding the public health workforce through grants to state and local governmental entities, $10 billion for obtaining medical supplies using the Defense Production Act, plus $3.5 billion in block grants evenly divided between mental health and substance abuse.

Education: This section would provide over $168 billion in funding for schools to address the COVID-19 pandemic, including $122.7 billion to the Elementary and Secondary School Emergency Relief Fund (ESSERF) for state educational agencies and local educational agencies; and $39.6 billion to the Higher Education Emergency Relief Fund (HEERF) for public and private non-profit institutions of higher education. State education agencies would be required to reserve at least 5% of ESSERF funding to address learning loss, while local education agencies would be required to reserve 20% of their funding for that purpose.

States & Local Governments: This section would provide a total of $350 billion for states and localities to help with fiscal recovery from the COVID-19 pandemic. Funding could only be used in response to the COVID-19 pandemic, to cover related costs incurred, and to replace revenue lost due to the pandemic based on pre-pandemic financial projections. It would include:

$219.8 billion for the Coronavirus State Fiscal Recovery Fund, of which $195.3 billion would go to the 50 states and the District of Columbia, $20 billion to tribal governments, and $4.5 billion to territories and commonwealths. Funding would remain available until it’s expended.

$130.2 billion for the Coronavirus Local Fiscal Recovery Fund, of which $45.57 billion would go to metropolitan cities, $65.1 billion to counties, and $19.53 billion to local governments with less than 50,000 inhabitants.

Pension Reforms: This section would make reforms to shore up insolvent pension programs, including those established by unions, with a cost of roughly $86 billion.

Multiemployer Pension Reform: This section would authorize the Pension Benefit Guaranty Corporation to take on some of the benefits of a failing multiemployer pension plan through a partition program so that the plan can stay solvent. Funding assistance would be in effect through 2026 after gradually phasing out during the interim period.

Single Employer Pension Plans: For plan years beginning in 2020, shortfalls could be amortized over 15 years instead of seven years. Interest rate smoothing corridors for stabilizing single employer pensions would be extended so that their phase-out wouldn’t have to begin in 2021.

Miscellaneous: This bill would also provide funding for the following:

$30 billion for federal transit grants, plus $8 billion for airports and $1.5 billion for Amtrak.

The National Endowment for the Arts and National Endowment for the Humanities would each receive $135 million, with 40% reserved for grants to state agencies and 60% for direct grants to support organizations’ programming.

The Institute of Museum and Library Services would receive $200 million, with each state receiving at least $2 million.

Federal workers who have to stay home with their children due to remote learning would receive $1,400 per week for 15 weeks.

Argument in favor

This relief bill would provide much needed economic assistance to American families through a round of $1,400 relief checks, extending the federal enhancement of unemployment benefits, and increasing tax relief for families. It would also provide funding for state and local governments, small businesses, and schools to ensure they have the financial resources necessary to weather the challenges caused by the pandemic.

Argument opposed

Democrats’ $1.9 trillion relief bill is poorly targeted and sends billions of dollars to pet projects, including a bailout of union pensions that were insolvent long before the pandemic. It would send relief checks and tax breaks to the wealthy, and fails to ensure that schools use the billions of dollars sent their way to reopen for in-person learning this year.

Impact

Individuals & families; small businesses; economically distressed sectors of the U.S. economy; healthcare providers & manufacturers of medical products; and the federal government.

Cost of H.R. 1319

The CBO estimates that enacting this bill would cost $1.9 trillion over the 2021-2030 period, of which $1.2 trillion would occur in 2021.

Additional Info

“What we do now will determine the strength, speed, and equity of our recovery. The American Rescue Plan has broad and united support because experts and community leaders — and Americans — understand the urgent need for bold action to end the pandemic, help workers, families, small businesses, and communities survive these crises, and generate a strong and inclusive recovery. As past crises have shown, doing too little will cost us far more in the end. The American Rescue Plan takes a multipronged approach to tackling the twin health and economic crises so we can save lives and livelihoods today and protect our economic future.”

Democrats chose to use the budget reconciliation process to enact this legislation, which allows them to pass it on simple majority votes in both chambers without needing any bipartisan support. President Joe Biden met with 10 Republicans who were willing to compromise on a smaller relief package, but Democrats didn’t pursue further negotiations after the meeting.

House Democrats included a provision requiring businesses to raise the minimum wage to $15 per hour in the initial version of this bill, although the Senate parliamentarian ruled that it violates the chamber’s rules related to reconciliation bills. That means Senate Democrats will either need to remove the $15 minimum wage from the package when it reaches the chamber or rework it so that its budgetary effects aren’t “incidental” to the non-budgetary components of the provision. While they could theoretically vote to overrule the parliamentarian with a simple majority, that would require all 50 Democratic senators to vote in favor and at least two, Sens. Joe Manchin (D-WV) and Kyrsten Sinema (D-AZ), have said they will not vote to overrule.

House Minority Leader Kevin McCarthy (R-CA) wrote an op-ed expressing his opposition to this package, which read in part:

“We could address the remaining needs through a similar, bipartisan approach. Unfortunately, President Joe Biden and Congressional Democrats chose to cut Republicans out of the process. After claiming on the campaign trail that he would be a “President for all Americans,” President Biden has made zero attempt at bipartisanship. They are using the coronavirus as an excuse to justify funding pet projects. For example, this bill calls for $100 million to fund a tunnel right outside Speaker Nancy Pelosi’s district. Other “urgent needs” include $50 million for Planned Parenthood, $685 billion that isn’t scheduled to be spent for another two years - about a third of the entire cost of the bill, and an additional $1,400 per week, up to $21,000 total, for federal employees who have kids out of school, but ignores millions of parents outside of D.C. who are also suffering through school closures, a crisis that has already forced one million American moms to leave the workforce. Worst of all, the Democrats’ bill fails to provide families and students any assurance their public schools will reopen full time.”

This legislation was drafted through the reconciliation process by 11 House committees, each of which reported their portion of the overall package on party-line votes, at which point the Budget Committee compiled a single package that was advanced on a party-line vote.

Of Note: The onset of the coronavirus pandemic in early 2020 prompted Congress to act on several occasions to boost the healthcare response and provide economic relief to Americans and their businesses left reeling in the wake of economic lockdowns. Here’s a look back at those bipartisan bills and how they became law:

“Phase 1” of the response was the Coronavirus Preparedness and Response Supplemental Appropriations Act, 2020 (H.R 6074), which provided $8.3 billion to fund the acquisition of medical supplies and develop treatments and vaccines. It was signed into law on March 6th after it passed the House 415-2 and the senate 96-1.

“Phase 2” was the Families First Coronavirus Response Act (H.R. 6201), which ensured the availability of free coronavirus testing, in addition to providing for paid leave under certain circumstances, and expanding food aid & unemployment insurance benefits during the outbreak. It was signed into law on March 18th after it passed the House 363-40 and the Senate 90-8.

“Phase 3” was the Coronavirus, Aid, Recovery, and Economic Security (CARES) Act (H.R. 748), which provided an estimated $2.2 trillion in funding for a variety of initiatives aimed at blunting the economic impact of the pandemic & bolstering the healthcare response to it. It includes $1200 “recovery rebate” checks for individuals (doubled for married couples) that phase-out for wealthier Americans, plus $500 per child; enhanced unemployment benefits; $350 billion in forgivable loans for small businesses under the Paycheck Protection Program (PPP); $500 billion in interest-bearing financial aid for larger, financially distressed corporations. It was signed into law on March 27th and passed the Senate 96-0 and the House on a voice vote. The CARES Act is the most expensive spending package ever enacted.

“Phase 3.5” was the Paycheck Protection Program and Health Care Enhancement Act (H.R. 266), which provided $484 billion to replenish the PPP and other Small Business Administration disaster loan programs; reimburse healthcare providers; and scale-up COVID-19 testing and tracing capacity. It was signed into law on April 24th and preceded a pair of bills later enacted to make PPP loans more useful to small business borrowers by broadening the forgiveness standards and increasing transparency for the public in terms of the entities receiving loans. The bill passed the Senate on a voice vote and the House 388-5.

“Phase 4” was included in the Consolidated Appropriations Act, 2021 (H.R. 133), and provided $900 billion in funding to finance a round of $600 recovery rebates for individuals; reopen the PPP for another round of loans to distressed small businesses; enhance unemployment benefits by $300 per week through mid-March 2021; help schools respond to the pandemic; and provide additional resources for public health efforts and vaccine distribution. The coronavirus relief measure was included with the $1.4 trillion omnibus spending bill for fiscal year 2021, which made the overall package one of the longest pieces of legislation ever enacted at 5,593 pages. It passed the House 359-53 and the Senate 92-6.

Media:

-

House Budget Committee Democrats Info Page

Causes (Biden $1.9T Plan)

Causes (Senate Parliamentarian Ruling)

Causes (Senate Vote-a-Rama)

Causes (Longest Vote in Senate History)

Causes (Senate Bill Reading)

Summary by Eric Revell

(Photo Credit: brucedetorres@gmail.com via Flickr / Public Domain)

The Latest

-

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy -

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment -

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... LGBTQIA+

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... LGBTQIA+ -

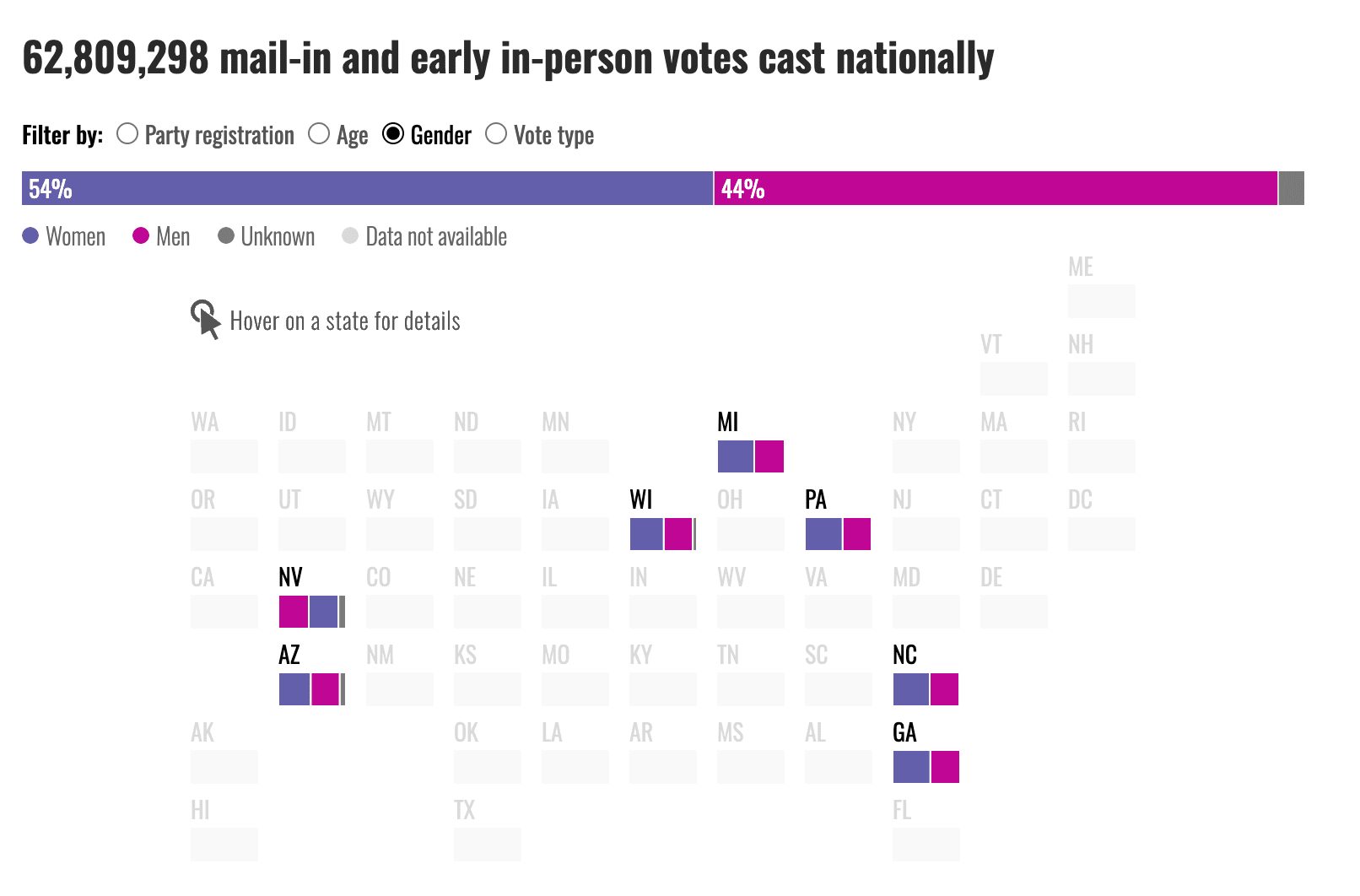

Women Are Shaping This Election — Why Is the Media Missing It?As we reflect on the media coverage of this election season, it’s clear that mainstream outlets have zeroed in on the usual read more... Elections

Women Are Shaping This Election — Why Is the Media Missing It?As we reflect on the media coverage of this election season, it’s clear that mainstream outlets have zeroed in on the usual read more... Elections

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security