Bipartisan Infrastructure Investment & Jobs Act: Funding Over $1 Trillion in Transportation, Energy, Water, & Broadband Infrastructure Programs (H.R. 3684)

Do you support or oppose this bill?

What is H.R. 3684?

(Updated March 16, 2022)

This bill was enacted on November 15, 2021

This bill has been amended to serve as the legislative vehicle for the bipartisan infrastructure bill known as the Infrastructure Investment and Jobs Act. In its original form, the bill was House Democrats’ $715 billion surface transportation and water infrastructure package, which passed the House on a largely party-line vote. In its current form, the Infrastructure Investment and Jobs Act would provide a total of $1.2 trillion in funding for infrastructure projects around the country including roads, bridges, rail, transit, ports, airports, the electric grid, water systems, and broadband. Further, it would reauthorize numerous existing programs and authorize new programs related to surface transportation and water resources. It would provide $550 billion in new spending over five years; offset some of that spending without raising taxes and increase the deficit by $256 billion over a decade according to the Congressional Budget Office (CBO) — although proponents of the bill suggest that the deficit impact may be smaller or non-existent due to offsets the CBO can’t score. A breakdown of the major provisions in the more than 2,700 page bill can be found below.

New Spending Pay-Fors: This section would offset new spending through a variety of pay-fors, including:

Approximately $210 billion from repurposing unused COVID relief dollars, including rescissions of funds provided under COVID relief bills prior to the American Rescue Plan, plus estimates of savings produced from reduced uptake and sunsetting of underutilized credits such as the Employee Retention Tax Credit (ERTC) and savings from the Paid Leave credits.

$56 billion in economic growth resulting from a 33% return on investment in these long-term infrastructure projects.

$53 billion from savings produced by states returning unused enhanced federal unemployment insurance supplemental funding.

$51 billion from delaying the Medicare Part D rebate rule.

$28 billion from applying reporting requirements to cryptocurrency.

$21 billion from extending fees on government-sponsored enterprises (e.g. Fannie Mae and Freddie Mac).

$20 billion from sales of future spectrum auctions and $67 billion from the proceeds of the February 2021 c-band auction.

$14.45 billion from reinstating certain Superfund fees.

$8.7 billion from the mandatory sequester.

$6 billion from extending customs user fees.

$6 billion in sales from the Strategic Petroleum Reserve.

$3 billion in savings from reducing Medicare spending on discarded medications from large, single-use drug vials.

$2.9 billion from extending available interest rate smoothing options for defined benefit pension plans.

ROADS, BRIDGES, & MAJOR PROJECTS

This section would provide $110 billion in new spending, including $55.46 billion in increased contract authority and $55.28 billion in supplemental appropriations, which would be allocated as follows:

$36.7 billion would increase investment in the EPW Bridge Investment Program, a competitive grant program which repairs and replaces deficient and outdated bridges to ease the repair backlog. This funding would also support a bridge formula program to help support the $125 billion bridge repair backlog (as estimated by the American Society of Civil Engineers).

$7.5 billion would boost funding for the Rebuilding American Infrastructure with Sustainability and Equity (RAISE) grants (formerly known as BUILD grants), which support surface transportation projects of local and/or regional significance.

$5 billion would fund a new National Infrastructure Project Assistance grant program which would support multi-modal, multi-jurisdictional projects of national or regional significance.

$3.2 billion for the Rebuilding America (INFRA) Grant Program, an increase over the baseline for the program, which supports highway and rail projects of regional and national significance.

$1.25 billion for the Appalachian Development Highway System formula program, which consists of highway corridors connecting 13 Appalachian states from New York to Alabama.

SURFACE TRANSPORTATION REAUTHORIZATION ACT

This section would reauthorize surface transportation programs and authorize new programs at the Dept. of Transportation (DOT) over FY2022-2026, provide funding for those programs in addition to setting obligation and contract limitations. The notable provisions of this section include:

An Alternative Fuel Corridors grant program would be established with a set-aside for Community grants, which would be designed to strategically deploy publicly accessible electric vehicle charging infrastructure, hydrogen fueling infrastructure, propane fueling infrastructure, and natural gas fueling infrastructure along designated alternative fuel corridors or in certain other locations that will be accessible to all drivers of electric vehicles, hydrogen vehicles, propane vehicles, and natural gas vehicles.

A congestion relief program would be established to provide competitive grants to states, localities, and metropolitan planning organizations for projects in large urbanized areas to advance innovative, integrated, and multimodal solutions to congestion relief in the most congested U.S. metropolitan areas.

A carbon reduction program would be established to reduce transportation emissions for eligible projects that establish or operate a traffic monitoring, management, and control facility or program, including advanced truck stop electrification systems; the construction, planning, and design of on-road and off-road trail facilities for pedestrians and bicyclists; a project for advanced transportation and congestion management technologies; deployment of infrastructure-based intelligent transportation systems capital improvements; installation of vehicle to infrastructure communications equipment; and a project to replace street lighting and traffic control devices with energy-efficient alternatives.

The Promoting Resilient Operations for Transformative, Efficient, and Cost-saving Transportation (PROTECT) grant program would be established to provide both formula and competitive grants to help states improve the resiliency of transportation infrastructure. Resilience grants would comprise community resilience and evacuation route grants, and at-risk coastal infrastructure grants.

The secretary of transportation would be required to study existing and future impacts of self-driving vehicles on transportation infrastructure, mobility, the environment, and safety, including on the Interstate Highway System, urban roads, rural roads, corridors with heavy traffic congestion, and transportation system optimization. It would include recommendations for both rural and urban communities about the impacts of self-driving vehicles on existing transportation system capacity.

A toll credit exchange would be established on a pilot basis to allow the DOT to study the feasibility of and demand for a toll credit marketplace in which states could sell, transfer, or purchase toll credits. Up to 10 states could participate in the pilot program.

A Healthy Streets program would be established to provide grants to entities for deploying cool pavements and porous pavements, and expanding tree cover to mitigate urban heat islands, improve air quality, and reduce the extent of impervious surfaces, stormwater runoff and flood risks, and heat impacts to infrastructure and road users.

Funding for the Territorial and Puerto Rico Highway Program would be increased, including a total of $900 million for Puerto Rico and $239 million for territories on the National Highway System for FY2022-2026.

The Appalachian Regional Commission (ARC) would be reauthorized and funded at $200 million annually over FY2022-2026. North Carolina’s Catawba and Cleveland counties and South Carolina’s Union county would be considered part of the Appalachian region for the purposes of the ARC.

The secretary of transportation would be required to issue a public notice 15 days in advance of issuing a waiver for the Buy America requirement for federal-aid highway projects and to report to Congress annually about all such waivers.

A wildlife crossing safety pilot program would be established to provide grants for projects designed to reduce wildlife-vehicle collisions and improve habitat connectivity.

National Motor Vehicle Per-Mile User Fee Pilot Program: The secretary of transportation and secretary of the treasury would be required to establish a pilot program to demonstrate a national motor vehicle per-mile user fee. The pilot program would provide different methods for volunteer participants to choose from to track motor vehicle miles traveled, with solicitations for participants from all 50 states, the District of Columbia, and Puerto Rico to ensure an equitable geographic distribution. Additionally, it would be required to include commercial and passenger vehicles in the pilot. For the purpose of the pilot program, the treasury secretary would establish annual, per-mile user fees for passenger motor vehicles, light trucks, and medium- and heavy-duty trucks. Amounts could vary between vehicle types and weight classes to reflect estimated impacts on infrastructure, safety, congestion, the environment, or other related social impacts.

Within one year after participation in the pilot program begins, the secretaries of transportation and the treasury would be required to submit a report to congressional committees that analyzes whether objectives were achieved, how volunteer participant protections were complied with, whether motor vehicle per-mile user fees can maintain the long-term solvency of the Highway Trust Fund, and improve and maintain the surface transportation systems. The report would include estimates over administrative costs related to collecting such motor vehicle per mile user fees, equity impacts of the pilot program, and impacts of the pilot program on low-income commuters.

Reconnecting Communities Pilot Program: This community connectivity pilot program would allow eligible entities to apply for planning funds to study the feasibility and impacts of removing, retrofitting, or mitigating an existing transportation facility that creates barriers to mobility, access, or economic development, and for construction funds to remove, retrofit, or mitigate such an entity, or replace it with a new facility if appropriate. Eligible entities would include a limited access highway, viaduct, or any principal arterial facility that creates a barrier to community connectivity.

Multimodal and Freight Infrastructure: This section would authorize funding for programs related to multimodal and freight infrastructure, including:

$10 billion over FY2022-2026 to establish the National Infrastructure Project Assistance Program, which would provide single- or multi-year grants to projects generating national or regional economic, mobility, or safety benefits for large and smaller-scale projects, including highway or bridge projects, freight intermodal or freight rail projects, railway-highway grade separation or elimination projects, intercity rail projects, and certain public transportation projects.

$1.5 billion a year for the Local and Regional Project Assistance Program (the RAISE/BUILD program) to provide grants to surface infrastructure projects that will have significant local or regional impacts.

Rail: This section would authorize funding for grants to Amtrak and rail-related infrastructure projects:

Amtrak’s National Network would receive an average of $2.5 billion annually while the Northeast Corridor would receive an average of $1.3 billion annually over the next five years.

The Consolidated Rail Infrastructure Safety and Improvements grant program would receive $1 billion per year over five years.

A new Railroad Crossing Elimination grant program would be established and funded with $500 million per year, including a small set-aside to carry out a highway-rail grade crossing safety information and education program.

The Federal Railroad Administration would receive an average of $263 million per year over five years for operations in addition to an average of $45 million per year for research and development activities.

Federal-State Partnership for Intercity Passenger Rail grants would be funded with $1.5 billion per year over five years.

Additionally, this section of the bill would enact reforms to rail programs, including:

Amtrak: The agency’s mission and goals would be amended to emphasize service to rural communities, recognize the value and importance of long-distance routes, and encourage Amtrak to maximize the benefits of federal investments. Oversight of Amtrak’s long-distance routes, intercity services, accounting, and spending would be increased. Amtrak would be prohibited from contracting out railroad work covered by a collective bargaining agreement during the time such an employee has been laid off and not recalled to work.

Rail Safety: The transportation secretary would be required to evaluate whether the railway-highway crossings program is sufficiently flexible for states to address grade crossing safety issues, and make recommendations to improve the program. Rail carriers that provide intercity passenger rail or commuter

Motor Carriers: This section would authorize appropriations out of the Highway Trust Fund for administrative expenses of the Federal Motor Carrier Safety Administration, including appropriations to carry out the motor vehicle safety assistance program, the high priority program, the commercial motor vehicle enforcement training and support grant program, the commercial motor vehicle operators grant program, and the financial assistance program for commercial driver’s license implementation. Additionally, it would:

Require the secretary of transportation to prescribe a motor vehicle safety standard and accompanying performance requirements for automatic emergency braking systems for heavy-duty commercial motor vehicles, and to require that systems installed in such vehicles be in use during operation.

Require the secretary of transportation to strengthen rear underride guard standards and to conduct additional research on the design and development of rear impact guards to prevent crashes at higher speeds.

Require the secretary of transportation to conduct research on crashworthiness and evacuation standards for limousines, and prescribe motor vehicle safety standards based on that research.

Provide grants to states to immobilize or impound passenger-carrying commercial motor vehicles that are determined to be unsafe or fail inspection.

Allow funding to support the recognition, prevention, and reporting of human trafficking as well as the detection of and enforcement of laws relating to such criminal activity.

Establish the Women of Trucking Advisory Board to identify barriers and industry trends that directly or indirectly discourage women from pursuing and retaining careers in trucking.

Highway & Motor Vehicle Safety: This section would authorize or reauthorize a variety of highway and motor vehicle safety programs, including:

Creating new safety program eligibilities to promote proper use of child restraints, improve recall awareness, prevent child heatstroke fatalities, reduce deaths and injuries from vehicles not moving over for stopped emergency response vehicles, and educate drivers to prevent misuse or misunderstanding of new vehicle technology.

Requiring the secretary of transportation to revise crash data systems to be able to distinguish between bicycles, electric scooters, and other individual personal conveyance vehicles from other vehicles involved in a crash.

Establishing a new grant program for states to modernize data collection systems to more efficiently share data with the National Highway Traffic Safety Administration (NHTSA).

Requiring the Governmental Accountability Office (GAO) to study federal and state efforts to improve awareness and enforcement of laws that require vehicles to change lanes or slow down when approaching an emergency vehicle on the roadside.

Requiring the secretary of transportation to conduct three high-visibility enforcement campaigns each year.

Requiring states with legalized marijuana to consider additional programs to educate drivers on the risks associated with marijuana-impaired driving.

Expanding the use of penalty funds for states that haven’t enacted or aren’t enforcing open container laws for impaired driving countermeasures beyond those focused on alcohol-impaired driving.

Requiring the secretary of transportation to study the effectiveness of state laws that make it illegal to pass a stopped school bus on the road and identify best practices to address vehicles that illegally pass stopped school buses, and to conduct a public safety messaging campaign to help prevent the illegal passing of school buses and improve the safe loading and unloading of school buses.

Requiring the secretary of transportation to update safety standards for vehicles with keyless ignition devices so that the vehicle automatically shuts off after it has idled for a designated period of time.

Requiring the secretary of transportation to mandate that all new motor vehicles be equipped with two crash avoidance technologies -- forward collision warning and automatic emergency braking systems, and lane departure and lane keeping assist systems.

Requiring the secretary of transportation to study driver monitoring systems to minimize driver distraction and disengagement and, if warranted, require a rulemaking.

Requiring the secretary of transportation to mandate that all new passenger motor vehicles be equipped with advanced drunk driving prevention technology that can passively monitor and accurately detect that a driver is impaired.

Public Transportation Reauthorization: This section would authorize or reauthorize a variety of public transit programs, including:

Reauthorization of Capital Investment Grants (CIG) programs.

Reauthorization of Federal Transit Administration (FTA) programs.

Reauthorization of Rural Area Formula grant programs.

Reauthorization of federal funding for the Washington Metropolitan Area Transit Authority through FY2030.

Authorization of State of Good Repair Grants.

Public Transportation: This section would provide $39 billion in new funding to address infrastructure needs within the nation’s public transit assets, including:

$19.15 billion in increased contract authority, an increase of 43% over baseline levels.

$8 billion for Capital Investment Grants to support new and expanded high-capacity rail and bus service.

$5.25 billion for Low-No Program to provide funding to state and local governments for the purchase or lease of zero-emission and low-emission transit buses, along with supporting facilities.

$4.75 billion for State of Good Repair grants to support efforts to address the backlog in deferred maintenance and replacement of public transit buses and rail transit assets in marginal or poor condition.

Passenger & Freight Rail: This section would provide $65 billion in new funding to address infrastructure needs within the U.S. rail network, including:

$36 billion for the Federal-State Partnership on Intercity Passenger Rail, including $24 billion set-aside for capital projects within the Northeast Corridor.

$16 billion for the Amtrak National Network, with funding going to update station locations, modernization projects, and improving safety.

$6 billion in grants for Amtrak’s Northeast Corridor between Washington and Boston to address the procurement and deferred maintenance backlog.

$5 billion to fund the Consolidated Rail Infrastructure and Safety Improvement (CRISI)

$3 billion for a competitive grant program to eliminate hazards at railway-highway crossings.

Safety & Research: This section would provide $11 billion in funding to address safety requirements in the national infrastructure, including:

$2.24 billion in increased contract authority for Federal Motor Carrier Safety Administration (FMCSA) grants and National Highway Traffic Safety Administration (NHTSA) grants.

$8.27 billion in supplemental appropriations, including $5 billion for the Safe Streets for All program to reduce crashes (especially for cyclists and pedestrians), $1.1 billion for NHTSA highway safety grants, $500 million for Strengthening Mobility and Revolutionizing Transportation Safety (SMART) grants.

ENERGY INFRASTRUCTURE

This section would authorize a total of $118.8 billion in funding for power infrastructure, including energy generation and transmission, resilience, Western water, and other related initiatives.

Grid Infrastructure: This section would authorize $5 billion over FY2022-2026 to establish grants for supporting activities to reduce the consequences of impacts to the electric grid due to extreme weather, wildfire, and natural disaster. Additionally, it would:

Allow Stafford Disaster Relief and Emergency Assistance grants to include wildfire within its hazard mitigation program.

Provide $6 billion for a new Program Upgrading Our Electric Grid Reliability and Resiliency to demonstrate innovative approaches to transmission, storage, and distribution infrastructure to harden resilience.

Require state regulators to consider the establishment of rate mechanisms to allow utilities to recover the costs of promoting demand-response practices.

Provide assistance for the creation of State Energy Security Plans that address all energy sources and potential hazards, along with a risk assessment and risk mitigation approach.

Increase the Bonneville Power Administration’s borrowing authority by $10 billion to assist in the cost of financing the construction, acquisition, and replacement of the Federal Columbia River Power System. BPA would be required to issue an updated financial plan that considers the projected and planned use and allocation of its borrowing authority across its mission responsibilities, and to engage with customers and stakeholders on financial and cost management efforts.

Rebalance the Columbia River Treaty to upgrade transmission capacity between Canada and the Western and Southwestern U.S. and authorize amounts equal to the aggregate amount of downstream power benefits that Canada is entitled to under the treaty ($1 billion).

Establish a demonstration project for second-life applications of electric vehicle batteries as aggregated energy storage installations to provide services to the electric grid.

Cybersecurity: This section would require the energy secretary, state regulatory authorities, industry, the Electric Reliability Organization, and other relevant federal agencies to carry out a program to promote and advance the physical security and cybersecurity of electric utilities, with priority to utilities with fewer resources. It would also:

Establish a voluntary Energy Cyber Sense program to test the cybersecurity of products and technologies intended for use in the bulk-power system.

Direct FERC to initiate a rulemaking to develop incentives encouraging investment in cybersecurity technology and participation in cyber threat information sharing programs.

Authorize $250 million over FY2022-2026 for the establishment of the Rural and Municipal Utility Advanced Cybersecurity Grant and Technical Assistance Program to help utilities detect, respond to, and recover from cyber threats.

Authorize $250 million over FY2022-2026 for the Cybersecurity for the Energy Sector Research, Development & Deployment program.

Clean Energy Supply Chains:

The Earth Mapping Resources Initiative would be codified to accelerate mapping efforts at the U.S. Geological Survey (USGS) to complete an initial comprehensive national modern surface and subsurface mapping and data integration effort to better understand U.S. domestic mineral resources. The USGS would receive $320 million over FY2022-2026 for this purpose.

An abandoned mine land and mine waste geologic mapping component would be included in the mapping program to ensure mine waste is catalogued and characterized for the occurrence of critical minerals, and the existing program would be extended through 2031.

USGS would receive $167 million for a research facility to support energy and minerals research.

Federal permitting processes related to critical mineral production on federal land would be improved.

The Dept. of Energy (DOE) would receive $140 million in FY2022 to demonstrate the feasibility of a full-scale integrated rare earth element extraction and separation facility and refinery to strengthen domestic clean energy supply chains and provide environmental benefits through the reuse and treatment of waste material.

A Battery Material Processing Grant Program would be established within DOE’s Office of Fossil Fuel to ensure the U.S. has a viable battery materials processing industry.

$750 million would be authorized over FY2022-2026 for the establishment of a grant program focused on small- and medium-sized manufacturers to build new or retrofit existing manufacturing and industrial facilities to produce or recycle advanced energy products in communities where coal mines or coal power plants have closed.

$200 million for the expansion of the DOE’s research, development, and demonstration of electric vehicle battery recycling and second-life applications for vehicles would be authorized over FY2022-2026.

Carbon Capture, Utilization, Storage, and Transportation: This section would provide:

$3.5 billion to contribute to the development of four regional direct air capture hubs would be provided over FY2022-2026.

$3.1 billion to establish a CO2 Infrastructure Finance and Innovation Act program would be provided over FY2022-2026 to provide flexible, low-interest loans for CO2 transport infrastructure projects and grants for initial excess capacity on new infrastructure.

$2.5 billion to expand the DOE’s Carbon Storage Validation and Testing program would be provided over FY2022-2026 to include large-scale commercialization of new or expanded carbon sequestration projects and associated carbon dioxide transport infrastructure.

Hydrogen Research and Development: This section would provide:

$8 billion to establish at least four regional clean hydrogen hubs to demonstrate production, processing, delivery, storage, and end-use of clean hydrogen would be provided over FY2022-2026.

An additional $1 billion would be provided over that period for a demonstration, commercialization, and deployment program intended to decrease the cost of clean hydrogen production.

Nuclear Energy:

The DOE would be required to develop a report on the feasibility of using nuclear energy to meet the agency’s resilience and carbon reduction goals, including micro and small modular nuclear reactors.

$6 billion would be provided over FY2022-2026 for a civil nuclear credit program, which would establish a process to evaluate bids through an auction process and select certified nuclear reactors to receive credits.

Hydropower:

The energy secretary would be directed to make incentive payments to the owners and operators of hydroelectric facilities for capital improvements related to maintaining and enhancing hydroelectricity generation by improving grid resiliency, improving dam safety, and environmental improvements. $533.6 million would be provided in FY2022 and remain available until expended.

$125 million for hydroelectric production incentives would be authorized in FY2022 which would be available until expended.

$75 million for hydroelectric efficiency improvement incentives would be provided in FY2022 which would be available until expended.

Energy Efficiency: This section would provide funding for a variety of energy efficiency initiatives, including:

$550 million over FY2022-2026 for institutions of higher education-based industrial research and assessment centers to identify opportunities for optimizing energy efficiency and environmental performance at manufacturing and other industrial facilities, in addition to a grant program to fund upgrades at small- and medium-sized manufacturers.

$500 million over FY2022-2026 for competitive grants to be awarded to public schools for making energy efficiency, renewable energy, and alternative fueled vehicle upgrades.

$250 million for FY2022 to create a revolving loan fund capitalization grant program within the State Energy Program for recipients to conduct commercial energy audits, residential energy audits, or energy upgrades or retrofits.

$225 million over FY2022-2026 to create a grant program within the Building Technologies Office to enable sustained, cost-effective implementation of updated building energy codes.

$50 million over FY2022-2026 to establish a program to provide funding for states to invest in smart manufacturing technologies.

Additionally, this energy section of this bill would provide:

$11.2 billion for the Abandoned Mine Land Reclamation Fund, while adjusting rates of the Abandoned Mine Reclamation Fee.

$4.7 billion for programs to plug, remediate, and reclaim orphaned wells on federal, state, and tribal lands.

$3.5 billion for the Weatherization Assistance Program.

$3.4 billion for Carbon Capture Large-Scale Pilot Projects and Carbon Capture Demonstration Projects over FY2022-2025.

$3.2 billion for the Advanced Reactor Demonstration Program over FY2022-2027.

$825 million over FY2022-2026 for the National Geological and Geophysical Data Preservation Program; Rare Earth Mineral Program; Critical Material Innovation, Efficiency, and Alternatives; and a Critical Mineral Supply Chain Research Facility.

$500 million for industrial emissions demonstration projects.

$355 million for energy storage demonstration projects, plus $150 million for a long-duration demonstration.

Natural Resources: This section would authorize funding for natural resources-related infrastructure, wildfire management, and ecosystem remediation, including:

$3.3 billion for the Dept. of the Interior (DOI) and Forest Service for wildfire risk reduction by providing funding for community wildfire defense grants, mechanical thinning, controlled burns, the Collaborative Forest Restoration Program, and firefighting resources.

$2.1 billion for the DOI and Forest Service to restore the ecological health of federal lands and waters and of private lands, through voluntary efforts, via a variety of programs, including through partnerships with states.

$250 million for the Forest Service’s Legacy Road and Trail program, which restores fish passage in streams at road and trail crossings, decommissions unauthorized user-created roads and temporary roads.

Western Water Infrastructure: This section would authorize $8.3 billion over FY2022-2026 for Bureau of Reclamation water infrastructure, including:

$3.2 billion for aging infrastructure.

$1.15 billion for water storage, groundwater storage and conveyance projects (including $100 million for small water storage).

$1 billion for water recycling and reuse projects (including $450 million for large water recycling projects).

$1 billion for rural water projects.

$500 million for dam safety projects.

$400 million for waterSMART Water and Energy Efficiency Grants (including $100 million for natural infrastructure projects).

$300 million for the Drought Contingency Plan.

$250 million for desalination projects.

Projects funded under this section would be required to pay wages that are at least equal to those prevailing on similar projects in the locality.

WATER INFRASTRUCTURE

This section would provide a total of $55 billion in new spending for water infrastructure programs, including:

$23.4 billion in additional funding for traditional Drinking Water and Clean Water State Revolving Funds (SRF), which provide below-market rate loans and grants to fund water infrastructure improvements to protect public health and the environment.

$13.8 billion in increased SRF loan authority.

$15 billion for the Drinking Water SRF that is to be directed to the replacement of lead service lines without a state cost share. Of the total, 49% would be administered as grants and completely forgivable loans.

$10 billion for perfluoroalkyl or polyfluoroalkyl substance (PFAS) contaminant mitigation by states and water utilities for drinking water and wastewater systems. States wouldn’t be required to provide a cost share and up to 100% of funding would be administered as grants.

$2.5 billion to establish a fund known as the Indian Water Rights Settlement Completion Fund that would be used to satisfy the Dept. of the Interior’s obligations under an Indian water rights settlement.

DRINKING WATER

Funding for the Drinking Water State Revolving Loan Fund would be reauthorized and increased as follows: $2.4 billion for FY2022; $2.75 billion for FY2023; $3 billion for FY2024; $3.25 billion for FY2025 and FY2026.

The Assistance for Small and Disadvantaged Communities program would be authorized to receive $70 million for FY2022; $80 million for FY2023; $100 million for FY2024; $120 million for FY2025; and $140 million for FY2026.

Funding for the Environmental Protection Agency (EPA) to provide technical assistance and grants for emergencies affecting public water systems at $35 million annually for the FY2022-26 period. Technical assistance to small public water systems would receive $15 million annually for FY2022-26.

The Drinking Water System Infrastructure Resilience and Sustainability program would be authorized at $25 million for the FY2022-26 period with a 90% federal cost share for aid to small, rural, and disadvantaged communities.

Several initiatives to reduce lead in drinking water infrastructure would be facilitated by this bill, including $10 million for a pilot program to help communities use mapping information. Funding would be authorized to address lead in school drinking water systems, including $30 million for FY2022; $35 million for FY2023; $40 million for FY2024; $45 million for FY2025; and $50 million for FY2026.

Additionally, this section would require:

The EPA to study community water needs, including in rural areas, and provide recommendations on providing affordable and safe drinking water and wastewater.

Creation of a pilot program to provide grants to develop and implement programs to help needy households maintain access to drinking water and wastewater treatment.

Creation of a program to facilitate grants to link households to public water infrastructure, with $20 million annually from FY2022-26.

CLEAN WATER

Funding for the Clean Water State Revolving Loan Funds would be authorized at $2.4 billion for FY2022; $2.75 billion for FY2023; $3 billion for FY2024; and $3.25 billion for FY2025 and FY2026.

Funding under the Clean Water Act for research, investigations, training, and information would be authorized at $75 million annually for FY2022-26.

A pilot program would be created to facilitate grants for projects that seek to bolster waste-to-energy projects and authorized with $20 million annually for the program from FY2022-26. It would also stipulate that grants not exceed $4 million.

An existing pilot program for alternative water source projects would be reauthorized with $25 million annually for FY2022-26.

EPA would be directed to create a clean water infrastructure resiliency and sustainability program to provide grants aimed at protecting water systems from weather events and cybersecurity risks. The program would be authorized at $25 million annually for FY2022-26.

A circuit rider program for small and medium sized, publicly owned treatment works would be created by the EPA. It would be authorized to receive $10 million in annual funding for FY2022-26.

The EPA would be directed to create an efficiency grant program for small publicly owned treatment works to support water and energy efficiency in disadvantaged communities, as well as those in rural areas with a population of less than 10,000 people.

The Innovative Water Infrastructure Workforce Development program would be reauthorized at $5 million annually for FY2022-26. A federal interagency working group would be created to report to Congress on bolstering the water and wastewater utility workforce. The working group would consist of members from the EPA, the Dept. of Education, the Dept. of Labor, the Dept. of Agriculture, the Dept. of Veterans Affairs, and other appropriate federal agencies.

EPA would be directed to create a water data sharing pilot program aimed at ensuring the coordination of data and information regarding water quality and needs between state and local governments. It would be authorized at $15 million annually for FY2022-26.

Additionally, this bill would:

Reauthorize the Water Infrastructure Financing and Innovation Act program at $50 million annually for FY2022-26.

Direct EPA to facilitate grants to institutions to serve as centers of excellence for stormwater control infrastructure technologies.

Direct EPA to create a Water Reuse Interagency Working Group to identify ways to support water reuse and compile a national action plan to support the initiative.

Airports: This section would provide a total of $25 billions funding for airports and air traffic control facilities, including:

$20 billion for Airside projects, such as runways and taxiways, and Terminal projects. Of the total, $15 billion would be provided through formula funding grants ($3 billion annually over five years) for Airport Improvement Program projects like runways and taxiways, terminal development, noise, multimodal, or airport-owned towers; while $5 billion ($1 billion annually over five years) for the Airport Terminal Program, a discretionary grant program for terminal development and landside projects.

$5 billion for the Federal Aviation Administration’s facilities and equipment, including FAA-owned contract towers.

Clean Buses and Ferries: This section would provide $1 billion annually over the next five years for the implementation of a school bus change out program to reduce emissions and improve public health. State and local governments, eligible contractors, and non-profit school transportation associations could receive grants, 50% of which are authorized for zero-emission school buses and 50% of which are authorized for alternative fuels and zero-emission school buses. Funds could be prioritized for rural or low-income communities and entities with matching funds available.

The Federal Transit Administration’s Passenger Ferry Grant Program would receive $1.25 billion. The secretary of transportation would be directed to establish a $1 billion Basic Essential Ferry Service, with eligible places serving at least two rural areas that have had ferry transportation services from 2015-2020.

Broadband: This section would provide a total of $65 billion to improve broadband infrastructure and reduce the digital divide. This total would include:

$42.45 billion for state deployment grants using a formula-based grant system for states, territories, and the District of Columbia to deploy broadband without favoring particular technologies or providers. Projects would have to meet a download/upload build standard of 100/20 megabits per second. It would include a 10% set-aside for high-cost areas and each state and territory would receive an initial minimum allocation, a portion of which could be used for technical assistance and supporting or establishing a state broadband office. Funding recipients would be obligated to offer a low-cost plan to receive funding. States would be required to have enforceable plans to address their unserved areas before they fund deployment projects in underserved areas; after both unserved and underserved areas are addressed, states could use funds for anchor institution projects.

$14.2 billion for the creation of a permanent, sustainable Affordable Connectivity Benefit to help low-income families access the internet. The program would provide a $30 per month voucher for low-income families to use toward any internet service plan of their choosing.

$2.75 billion for the Digital Equity Act, which is included in this section and would promote digital inclusion through grants to accelerate the adoption of broadband through digital literacy training, workforce development, devices access programs, and other digital inclusion measures.

$2 billion for additional funding of the Tribal Broadband Connectivity Program, which provides funding to eligible Native American, Alaska Native and Native Hawaiian entities for broadband deployment as well as digital inclusion, workforce development, telehealth, and distance learning.

$2 billion in additional support for rural broadband initiatives through programs administered by the U.S. Dept. of Agriculture (USDA).

Ports & Waterways: This section would provide a total of more than $10 billion in funding for projects related to ports and waterways, including:

$9.55 billion for Army Corps of Engineers infrastructure priorities, including $5.15 billion for authorized projects that are backlogged and haven’t received funding. It includes a $4 billion set-aside for Corps Operations and Maintenance, which would be spent over three years and include funding for dredging federal navigation projects and repairing damages to Corps projects caused by natural disasters.

$3.85 billion to modernize and improve Land Ports of Entry at the U.S. Northern and Southwest Borders. This funding would be split between the General Services Administration (GSA) and Customs and Border Protection (CBP), and would allow the execution of construction and modernization projects at all ports on CBP’s five-year plan as well as those prioritized for upgrades.

$455 million annually for five years for the Dept. of Transportation’s Port Infrastructure Development Program (PIDP) and Marine Highways Program (MHP), which would allow for improvements at port facilities on coasts, rivers, and Great Lakes.

$429 million for U.S. Coast Guard infrastructure priorities, including projects on the Coast Guard’s unfunded priorities list. Funding would be provided for housing, family support and childcare facilities, as well as shore construction infrastructure and facility deficiency needs.

RESILIENCY

Flood Mitigation: This section would provide funding for a number of flood mitigation and resiliency programs, including:

$7 billion for the Army Corps of Engineers to address infrastructure priorities, including $6 billion for construction projects to address the backlog of authorized projects that haven’t yet received funding.

$3.5 billion for the Federal Emergency Management Agency (FEMA) Flood Mitigation Assistance program, which provides financial and technical assistance to states and communities to reduce the risk of flood damage to homes and businesses through buyouts, elevation, and other activities.

$500 million for the STORM Act to provide support through loans and grants to local communities facing rising water levels, coastal erosion, and flooding that put homes and property at risk and caused millions of dollars in damage.

$492 million for the National Oceanic and Atmospheric Administration (NOAA) National Coastal Resiliency Fund, which partners with the National Fish and Wildlife Foundation to improve the resilience of coastal communities to flooding and inundation by restoring or expanding natural ecosystems, while enhancing fish and wildlife habitats and increasing protection for communities from coastal hazards.

$492 million for NOAA mapping, observations, and modeling.

$491 million for the NOAA Community-Based Restoration Project, which buffers shorelines from erosion to reduce flooding and remove potentially hazardous structures.

Building Resilient Infrastructure & Communities (BRIC) Program: The BRIC program would receive $1 billion for pre-disaster mitigation activities that support states, local communities, tribes and territories undertaking hazard mitigation projects to reduce risks they face from disasters and natural hazards.

Waste Management: This section would provide funding for waste management resiliency projects, including:

$275 million for Post-Consumer Materials Management Grants under the Save Our Seas Act 2.0 to support improvements to local post-consumer materials management, including municipal recycling programs.

$200 million for the NOAA Marine Debris Program, which promotes the reduction of debris in the ocean through clean up and response actions needed after severe marine debris events.

$150 million for critical mineral and battery recycling to address the lack of domestic policy, markets, and infrastructure regarding the coordinated collection, recycling, and reuse of single use and rechargeable consumer batteries containing materials needed to support of a U.S.-based supply chain.

$100 million for the EPA Pollution Prevention Program, which provides grants and technical assistance to help businesses adopt pollution prevention practices.

Drought: This section would provide funding for a number of drought resiliency projects, including:

$2.2 billion over five years for the Aging Infrastructure Account, which provides funds and funding assistance to the Bureau of Reclamation for costs of certain major, non-recurring maintenance of bureau-owned water infrastructure at projects across the West that are in need of major upgrades or replacement.

$500 million over five years for the Wester Area Power Administration’s power purchase and transmission activities to infuse funds needed to avoid depletion of WAPA’s power purchase funding, which would result in electricity rate increases to customers across 15 states.

$1.7 billion over five years for Indian Health Services Sanitation Facilities Construction Enhancement, which would allow for the improvement of sanitation and water infrastructure on tribal lands at facilities owned in whole or in part by the Indian Health Service.

$100 million over five years for Drought Contingency Plan Funding, evenly divided between the Upper and Lower Colorado Basins, for drought contingency operations such as monitoring and reclamation at Lake Powell and Lake Mead.

Ecosystems: This section would provide funding for a number of federal ecosystem restoration programs, including:

$1 billion for the Great Lakes Restoration Initiative by the EPA.

$500 million for USACE Ecosystem Restoration.

$238 million for Chesapeake Bay restoration by the EPA.

$207 million for the Coastal Zone Management Program by NOAA.

$172 million for the Pacific Coastal Salmon Recovery Fund by NOAA.

$150 million for Oceans and Coastal Observations by NOAA.

$132 million for the National Estuary Program, including 28 estuaries, by the EPA.

$106 million for Long Island Sound restoration by the EPA.

Wildfire Management: This section would provide funding and reforms for a number of wildfire management resiliency initiatives, including:

$5.75 billion for Title VIII of the Energy Infrastructure Act, which would provide for natural resources-related infrastructure, wildfire management, and restoration.

$514 million over five years for the Forest Service to carry out hazardous fuels reduction projects, including $40 million for projects covered by the Tribal Forestry Protection Act and $60 million for Community Wood Energy and Wood Innovation Grants.

$500 million over five years for Forest Service Community Defense Grants.

$300 million over five years for the USDA Natural Resources Conservation Service for the Emergency Watershed Protection Program.

$225 million over five years for the Dept. of the Interior (DOI) to carry out Burned Area Rehabilitation activities.

$225 million over five years for the Forest Service to carry out Burned Area Recovery activities.

$200 million over five years for the Forest Service to carry out State and Private Forestry grants to states for hazardous fuel work, with an additional $88 million for State Fire Assistance grants and $20 million for Volunteer Fire Assistance grants.

$100 million for FY2022 for NOAA Fireweather Testbed programs, which would be used to procure new systems and recapitalize existing and outdated systems to improve wildfire prediction, detection, observation, modeling, and forecasting.

The REPLANT Act, included in this section, would remove the $30 million per year cap on the Reforestation Trust Fund and help the Forest Service plant 1.2 billion trees on national forest lands. Currently, the Reforestation Trust Fund is funded by tariffs on imported wood products and revenues over $30 million go to the Treasury’s General Fund.

The Wildland Fire Mitigation & Management Commission Act of 2021, included in this section, would establish a commission to study and recommend wildland fire prevention, mitigation, suppression, management, and rehabilitation policies.

Cyber: This section would provide funding for a number of cyber resiliency initiatives, including:

$1 billion over four years for the State, Local, Tribal, and Territorial (SLTT) Grant Program, which will establish a new grant program to provide federal aid to SLTT entities.

$100 million over five years for the Cyber Response and Recovery Fund, which would allow the secretary of homeland security to declare a Significant Incident after a breach of public and private networks and a fund that would allow CISA to provide direct support to public or private entities responding to and recovering from significant cyberattacks.

Transportation: A Promoting Resilient Operations for Transformative, Efficient, and Cost-saving Transportation (PROTECT) grant program would be created and funded with $8.7 billion in contract authority from the Highway Trust Fund. That would include $7.3 billion in formula grants to be distributed to states plus $1.4 billion in competitive grants for state and localities to improve the resiliency of transportation infrastructure. Resilience grants would include resilience improvement grants, community resilience and evacuation route grants, and at-risk coastal infrastructure grants.

Environmental Cleanup: This bill would increase funding for environmental cleanup programs, including:

$1.5 billion would be provided over five years for state and tribal assistance grants to address Brownfields and safely clean up contaminated properties for sustainable reuse (all cost share requirements would be waived). Additionally, $1.2 billion would be provided for Brownfields competitive grants, half of which would come from raising grant caps; and another $300 million would be provided for Brownfields categorical grants to support state-led Brownfields efforts.

$3.5 billion would be available for five years for Superfund’s Remedial account within the Hazardous Substance Superfund, which would allow the Environmental Protection Agency to invest in clean-ups and continue moving forward with remedial actions for Superfund sites.

Private Sector Leveraging Provisions: This section would create and expand a variety of programs that leverage additional private sector investment in infrastructure programs to create jobs and strengthen the economy. This would include:

Expanding the eligible uses of Private Activity Bonds (PABs) to include qualified Broadband projects, particularly in rural and underserved communities, and carbon dioxide capture facilities.

Increasing the current cap of tax-exempt highway or surface freight transfer facility bonds from $15 billion to $30 billion, which would allow state and local governments to enter into additional public-private partnerships to supplement future transportation projects with private investment (nearly all of the current $15 billion cap has been used).

Enabling the secretary of transportation to provide technical assistance and other resources to state and local transportation agencies that are interested in engaging the private sector in public-private partnership, asset concessions, and other innovative financing. This provision would be funded with $20 million per year.

Requiring applicants for TIFIA and Railroad Rehabilitation & Improvement Financing loans for projects over $750 million in costs to conduct a Value for Money (VfM) analysis to evaluate the benefits of a P3 financing option for significant projects. Conducting a VfM analysis helps public entities compare the P3 model against traditional public-sector funding and financing by reviewing projected, risk-adjusted life-cycle costs.

Permitting Provisions: This section would lift the sunset on permitting reforms enacted under the Fixing America’s Surface Transportation (FAST) Act’s Title 41 (FAST-41), which overhauled permitting procedures to reduce timelines, create jobs, resolve interagency conflicts, and left environmental protections in place. This would effectively make FAST-41 permanent, while expanding it to tribal projects, setting a two-year goal for permitting covered projects, encourage federal agencies to use one document to track permitting decisions (“One Federal Decision”), and improve the Permitting Council’s day-to-day operations.

ADOPTED AMENDMENTS

- Schumer Amendment (#2570) - Offered by Sen. Chuck Schumer (D-NY), this amendment would establish safety standards for certain limousines.

- Fischer Amendment (#2164) - Offered by Sen. Deb Fischer (R-NE), this amendment would require the establishment of an online interactive map displaying the locations of federally-funded broadband deployment projects to promote transparency.

- Bennet Amendment (#2548) - Offered by Sen. Michael Bennet (D-CO), this amendment would require the Dept. of Agriculture to establish a Joint Chiefs Landscape Restoration Partnership program.

- Carper Amendment (#2564) - Offered by Sen. Tom Carper (D-DE), this amendment would improve provisions in the bill providing funding for the Army Corps of Engineers.

- Rosen Amendment (#2358) - Offered by Sen. Jacky Rosen (D-NV), this amendment would modify a provision providing support for activities to increase the resiliency of the National Highway System to mitigate damages from wildfires.

- Cardin-Wicker Amendment (#2478) - Offered by Sens. Ben Cardin (D-MD), this amendment would require the Minority Business Development Agency of the Dept. of Commerce to promote and administer programs in the public and private sectors to assist the development of minority business enterprises.

- Peters-Rounds Amendment (#2464) - Offered by Sens. Gary Peters (D-MI) and Mike Rounds (R-SD), this amendment would modify cybersecurity provisions of the underlying bill.

- Van Hollen Amendment (#2354) - Offered by Sen. Chris Van Hollen (D-MD), this amendment would include payment and performance security requirements for infrastructure financing under this bill.

- Cruz-Warnock Amendment (#2300) - Offered by Sens. Ted Cruz (R-TX) and Raphael Warnock (D-GA), this amendment would designate additional high priority corridors within the National Highway system, including specified roadways in Texas, Georgia, Oklahoma, Arkansas, Kentucky, Louisiana, Mississippi, Alabama, North Carolina, and South Carolina.

- Lummis-Kelly Amendment (#2181) - Offered by Sens. Cynthia Lummis (R-WY) and Mark Kelly (D-AZ), this amendment would require the Dept. of Transportation to study the direct costs of highway use by various types of users within four years. Specifically, it would consider the federal costs in design, construction, rehabilitation, and maintenance of federal-aid highways based on the use of vehicles of different dimensions, weights, axles, and other specifications; their frequency in the traffic stream; the safety, emissions, congestion, and noise-related costs created by them; and the proportionate share of costs attributable to each class of highway users.

- Thune-Tester Amendment (#2162) - Offered by Sens. John Thune (R-SD) and Jon Tester (D-MT), this amendment would identify ways in which the number of workers enrolled in 5G training programs can be expanded to grow the telecommunications workforce.

- Padilla-Moran Amendment (#2133) - Offered by Sens. Alex Padilla (D-CA) and Jerry Moran (R-KS), this amendment would make it easier for funding under this bill to be used to improve healthcare facilities for Indian tribes by striking requirements that renovations meet now-obsolete accreditation standards and only use the funding they already receive.

Argument in favor

It isn’t perfect, but this bill represents a good-faith, bipartisan compromise that would provide much needed funding for a wide variety of physical infrastructure projects, including roadways, water systems, the energy grid, public transit, and expanding the availability of broadband internet to create jobs without raising taxes. Additionally, it’s closer to being fully offset than the Congressional Budget Office recognizes because it would repurpose unspent COVID relief funding.

Argument opposed

While it may have bipartisan support, this infrastructure plan includes too much new spending that isn’t fully offset by pay-fors and will increase the deficit by $256 billion over a decade according to the Congressional Budget Office. Additionally, it includes a pilot program to study the use of per-mile user fees to fund road infrastructure projects that could eventually be imposed on all motor vehicle users.

Impact

Users of highways, roads, public transit, the energy grid, water systems, and broadband internet; federal, state, and local agencies overseeing infrastructure projects.

Cost of H.R. 3684

The Congressional Budget Office estimates that enacting this bill would result in a net increase in projected budget deficits of $256 billion over the FY2021-2031 period. A number of offset provisions in the bill were not scoreable by the CBO, which are described below.

Additional Info

In-Depth: This legislation was drafted by a bipartisan group of 22 senators from each side of the aisle. A subgroup of 10 bipartisan senators, including Sens. Rob Portman (R-OH), Kyrsten Sinema (D-AZ), Susan Collins (R-ME), Joe Manchin (D-WV), Mitt Romney (R-UT), Mark Warner (D-VA), Lisa Murkowski (R-AK), Jeanne Shaheen (D-NH), Bill Cassidy (R-LA), and Jon Tester (D-MT), issued a joint statement on its introduction:

“Over the last four days we have worked day and night to finalize historic legislation that will invest in our nation’s hard infrastructure and create good-paying jobs for working Americans in communities across the country without raising taxes. This bipartisan bill and our shared commitment to see it across the finish line is further proof that the Senate can work. We look forward to moving this bill through the Senate and delivering for the American people.”

Lead Republican sponsor Sen. Rob Portman (R-OH) offered the following remarks on the Senate floor in favor of the package:

“This is a really important bill because it takes our aging and outdated infrastructure in this country and modernizes it. And that’s good for everybody. It’s good for the truck driver who can leave home knowing he’s going to be safer on our roads and our bridges. It’s good for the mom who commutes to work and is sick of waiting in rush hour traffic on the way to work and on the way back because she’d rather spend more time with her kids. It’s good for the factory worker in Ohio who makes things that need to be transported. We make tanks in Ohio, we make cars in Ohio. We make washing machines. They go all over the world. Our ports – our land ports and our seaports – are inefficient and backed up. It’s good for our consumers who are waiting for products from all over the world because our ports are backed up… This helps make the economy more efficient, more productive, and therefore it actually returns an investment to the American people. We’re also going to hear about how it’s not going to increase inflation like some of the other spending that is being talked about around here, partly because it’s long-term spending for capital assets, it’s spending that’s going to add to the supply side, meaning it’s actually going to be counter-inflationary and create more jobs. We’ll hear all about that. But one thing that I do want to make sure that we hear about tonight is the fact that this process of starting from the center out has worked. People have talked about infrastructure in this city forever. President Trump had a $1.5 trillion infrastructure package. Ours is $550 billion, by the way. Five percent of his was paid for. Ours is paid for.”

Lead Democratic sponsor Sen. Kyrsten Sinema (D-AZ) offered the following remarks on the Senate floor in favor of this bill:

“It’s my honor and privilege this evening to join with the fellow nine senators at the G 10 who’ve been working together for months now, along with an additional 12 colleagues who together, the 22 of us Senators have worked long and hard with each other and with the White House to introduce this evening the bipartisan Infrastructure Investment and Jobs Act. We know that this has been a long and sometimes difficult process. But we are proud this evening to announce this legislation. And we look forward very much to working with our colleagues in a collaborative and open way over the coming days to work through this historic investment in infrastructure in our country and to come to agreement in the United States Senate to move forward with this historic piece of legislation... I know it has been difficult and I know that it’s been hard, and what I am proud to say is that this is what our forefathers intended when they created a system of government that required Republicans and Democrats to come together in a coequal branch of government and work with each other and with the administration to find legislation and solutions that meet the needs of our country’s individuals and families, companies, communities. It is difficult, it is time consuming, and it is exactly what our country insists and demands of us every single day to take the time to work with each other, to find common ground, to compromise and to be willing to work with each other, to give a little, to get a little, in order to achieve what’s right and what’s best for the American people.”

Sen. Bill Hagerty (R-TN), one of the Republican senators opposed to this package, offered remarks in opposition to it on the Senate floor:

“I’m in complete agreement that shorting up our hard infrastructure is a worthy cause. This bill does some of that, and that’s good. But, there are good and bad ways to achieve noble ends, and the question is: What is the best way to accomplish this goal? And my frustration is with the methods and vehicle being used here. The first problem is that the bill’s sponsors repeatedly said it would be paid for. It’s not. In fact, it’s not just a little bit off; it’s a quarter of a trillion dollars short. That’s almost 7 times the entire annual budget for the State of Tennessee. We waited weeks for the text of this legislation. Before the text even existed, the Democrat Leader forced the Senate to vote on proceeding to it. There’s absolutely no reason for rushing this process and attempting to limit scrutiny of this bill, other than the Democrat Leader’s completely artificial, self-imposed, politically driven timeline… The second reason I am opposed to this legislation is because of its Big-Government, top-down approach. It includes many half-baked components that deserve much further scrutiny. Rather than compete against China using our unparalleled economy, innovation, and ingenuity, we’re substituting massive government control to dictate, fund, and decide winners and losers. We’re using the cryptocurrency market as a pay-for. Have we fully vetted how this new regulation and taxation will affect this rapidly developing industry? Will leadership in this industry flee the United States as a result? What is the point of even having committees in the Senate with expertise in certain matters if the most significant legislation doesn’t even go through them. The whole point of committees is to use them—to carefully scrutinize and refine important legislation—to prevent unintended consequences that result from rushed legislation. This is a 2700-page bill going through no committees. Once again, we have to pass it to find out what’s in it, and learn as we go what kinds of unintended problems it will create.”

FreedomWorks, a conservative-libertarian activist organization, is opposed to the package and outlined why it is urging senators vote against it in a press release:

“Spending approximately $1.2 trillion over the next five years, the Infrastructure Investment and Jobs Act is yet another in a long list of bloated government spending bills. This bill throws billions of dollars at left-wing projects, is out of touch with the needs of everyday Americans, and gives the cover of “bipartisanship” to radical progressives that are currently pushing a massive $3.5 trillion budget resolution by a party-line vote. Advancing President Biden’s misguided climate agenda, the Infrastructure Investment and Jobs Act spends a combined $15 billion on electric vehicle (EV) infrastructure, electric buses, and other transit. This spending includes the construction of half a million new EV charging stations. Despite years of subsidies and tax credits, electric vehicles remain an expensive luxury purchased only by the financially well-off. While everyday Americans struggle with a dramatic rise in gas and grocery prices, politicians instead elect to make it easier for the well-off to charge their Teslas. This bill also spends a whopping $65 billion on rural broadband infrastructure. While bridging the digital divide is certainly a worthy goal, reckless government spending is not the solution. Rather than throwing money at the problem, our elected officials should be pursuing policies that use the power of the free market to expand access, such as the Gigabit Opportunity Act. Amtrak, a public company that consistently operates at multi-million dollar losses, would receive an increase in funding to the tune of $66 billion. This dramatic increase ignores the fact that for every mile Americans traveled by rail in 2019, they traveled 100 miles by road. This bill proposes a lousy investment for American infrastructure, dumping money into a program that Americans don’t use.”

This package includes a number of provisions which aim to offset the cost of new spending that the CBO was unable to score in its budgetary analysis of the bill, including:

Of the $210 billion in repurposed COVID relief funds, only $49 billion were scoreable, leaving $161 billion in proposed offsets unaccounted for.

Of the $87 billion from 5G spectrum auctions, only $20 billion were scoreable, leaving $67 billion in proposed offsets unaccounted for.

Of the $53 billion from the redirection of unused enhanced unemployment insurance relief funds, none were scoreable, leaving $53 billion in proposed offsets unaccounted for.

The $56 billion in offsets from dynamic scoring, which analyzes macroeconomic growth effects from the legislation, was not scored by the CBO.

This legislation contains much of the Senate’s Drinking Water and Wastewater Infrastructure Act of 2021, which would provide $35 billion in funding for new and reauthorized programs supporting drinking water and wastewater infrastructure. The bill passed the Senate on an 89-2 vote in April 2021.

Media:

-

Sen. Rob Portman (R-OH) Press Release

-

Sen. Kyrsten Sinema (D-AZ) Press Release

-

CBO Cost Estimate

-

Joint Committee on Taxation

-

Causes (Bill Amendments)

- Causes (Bipartisan Deal Reached)

- FreedomWorks (Opposed)

Summary by Eric Revell

(Photo Credit: iStock.com / Daniel Avram)The Latest

-

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy

The Long Arc: Taking Action in Times of Change“Change does not roll in on the wheels of inevitability, but comes through continuous struggle.” Martin Luther King Jr. Today in read more... Advocacy -

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment

Thousands Displaced as Climate Change Fuels Wildfire Catastrophe in Los AngelesIt's been a week of unprecedented destruction in Los Angeles. So far the Palisades, Eaton and other fires have burned 35,000 read more... Environment -

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... Families

Puberty, Privacy, and PolicyOn December 11, the Montana Supreme Court temporarily blocked SB99 , a law that sought to ban gender-affirming care for read more... Families -

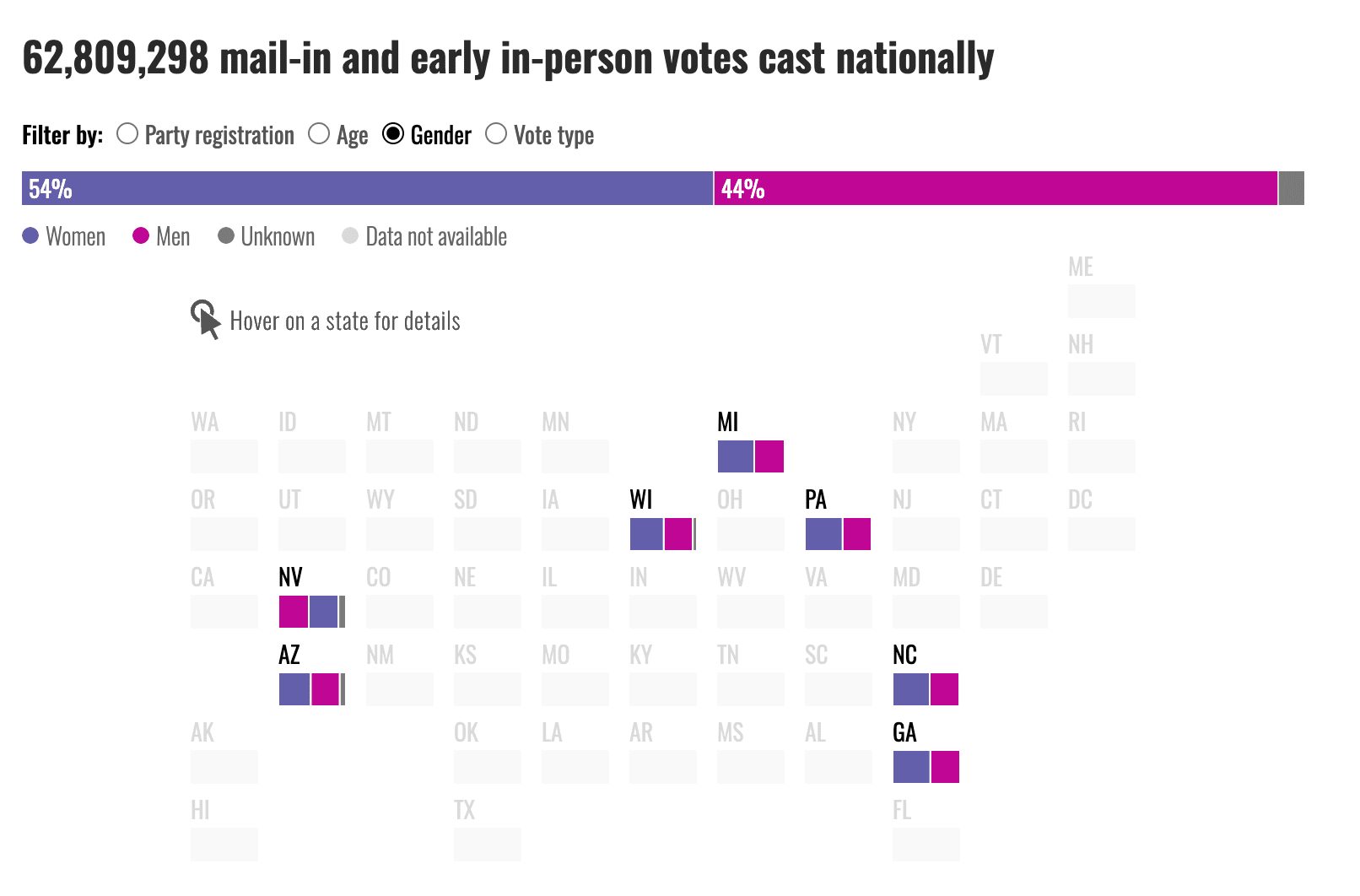

Women Are Shaping This Election — Why Is the Media Missing It?As we reflect on the media coverage of this election season, it’s clear that mainstream outlets have zeroed in on the usual read more... Elections

Women Are Shaping This Election — Why Is the Media Missing It?As we reflect on the media coverage of this election season, it’s clear that mainstream outlets have zeroed in on the usual read more... Elections

Climate & Consumption

Climate & Consumption

Health & Hunger

Health & Hunger

Politics & Policy

Politics & Policy

Safety & Security

Safety & Security